By Buster McNutt

So let me get this straight. If I’m a plumber, and I carry all my plumbing tools in my truck, I can write off the cost of the truck and all its expenses on my taxes. But if I’m a writer, and I carry all my writing tools in my truck, I’m not allowed to write off the cost of my truck and all its expenses? And what is it that I write about? Oh, I remember — car and truck stuff! Could I do that without owning and driving a vehicle as I gather all the research and experiences I need to write all those car and truck related articles, and to earn an income from writing, for which Uncle Sam fully expects me to pay income tax? Could Tom Brady make millions as an NFL quarterback if he didn’t also own a farm where he raised pigs that were eventually skinned to make footballs? And can Tom write off the costs of raising those pigs? You bet your deflated pigskin he can!

What, are plumbers somehow more important than writers in the general scheme of things? The Bible is the greatest book ever written, and there are zero plumbers mentioned in it! Did the Gideons go around putting pipe wrenches in hotel room? Are there Nobel and Pulitzer prizes for plumbing? In elementary school do they teach “Reading and Writing and Toilet Unstopping?” I think not.

Speaking of disallowed tax deductions, what about my $8,000 circular driveway? Many is the time I would just drive around and around waiting for the next Buster McNutt article idea to finally materialize. Once I ran over a squirrel on a trip around The Idea Driveway and ended up writing an article about all his relatives sneaking up in the middle of the night and chewing holes in my brake lines, so that the next day when I was taking an old toilet to the dump, and I hit my brakes to avoid a deer, I couldn’t stop, so I hit the deer and the toilet flew over the side and hit a skunk and, well, you can guess most of the rest. Without the idea for the article, I couldn’t write it, and if I didn’t write it, I wouldn’t get paid and the IRS wouldn’t get their tax money! And think of all the articles I’ve written about all our North Central Florida dirt roads. How many miles of those do you think I can write off? Spoiler alert: ZERO!

And apparently you have to be homeless and working in order to take an office-in-vehicle deduction. A lawn chair and laptop in the truck bed doesn’t qualify as an office for a writer. I guess you have to be a homeless plumber to pull that off.

How about the year that I grew tomatoes in the bed of my truck, or when I VELCRO’d chickens to the roof of the Estate Wagon? A couple laps around the block, and I had a week’s worth of eggs easy! Was I allowed a small farm deduction or even a soil depletion allowance when the dirt blew out of the truck? Nope. And don’t get me started about the time Latrell and I converted an old school bus to run on bio-friendly French-fry grease. You guessed it: I couldn’t write off all the trips to McDonalds to pick up the grease. And since these should all be classified as business trips (I wrote two articles on the bus conversion), I felt justified in taking a meal deduction for all those Quarter Pounders we consumed while waiting for the grease to cool down. We even ordered fries with our meals, because if we didn’t order fries, there would be no grease, and no grease means we wouldn’t have improved the environment by converting the Diesel Smoggy bus to an Earth-friendly renewable fuel, which means I wouldn’t have written the articles and the IRS wouldn’t have gotten their share! How could those meals not be deductable? I’m sure Tom Brady takes a meal deduction for the corn he eats before tossing the cobs over the fence to his two favorite pigs, Spalding and Wilson.

At least I thought I could get an advertising deduction for putting a “Buster McNutt, CAW (Certified Automotive Writer)” sign on the doors of my truck. No such luck, said the TurboCharged Tax software. I wasn’t trying to sell my “product” to consumers, so I’m going to add a second sign saying “Humor Article Reprints: $100.” I figure asking for $100 would prove I must be a humor writer. Maybe I’ll even get a loud speaker system and play audio tapes of my articles as I drive around. Latrell’s cousin Norbert can have a few beers, a handful of Twizzlers, a shot of Tabasco and sound just like James Earl Jones. The only fly in that particular banana pudding is that he can hardly read and is legally blind, which — oh by the way — allows him to write off the harness, food, and pooper scooper bags for his seeing eye dog!

So now to get a fair shake on tax deductions, I need to be a legally-blind plumber/NFL-farmer-quarterback who just happens to be married do a gorgeous super model? Only if I was legally blind just how super would she need to be? Let’s not go there.

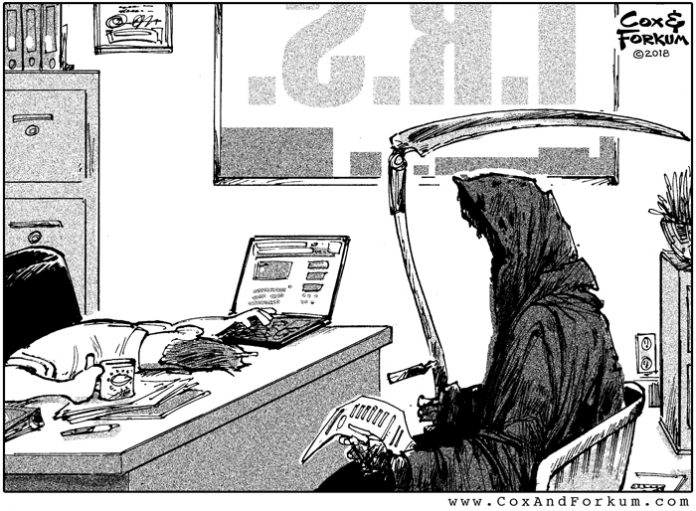

Santa Claus, the Easter Bunny, Free Beer Tomorrow, and a tax refund for Mr. Buster McNutt. When I say the check is in the mail, my signature is on that check and it is going to the IRS. The day I get a refund is the day Donald Trump’s arthritis gets so bad he has to hire someone to do his Tweeting for him. Like, maybe an adult film star. And you know what? I bet he could write her off his taxes! But Donald Trump with an adult film star?

Like that could really happen … •